#excel templates for financial statements

Explore tagged Tumblr posts

Text

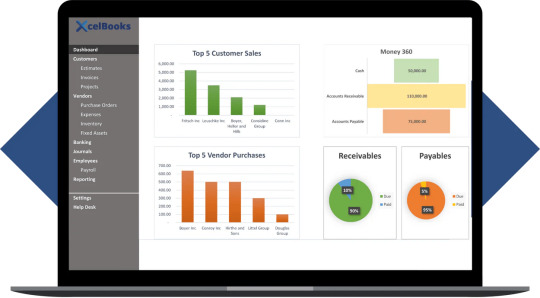

How to Use Accounting Software on Excel - A Beginner’s Guide by XcelBooks

Managing finances can be overwhelming, especially for small businesses, freelancers, and entrepreneurs who don't want to invest in expensive or complex accounting tools. Fortunately, accounting software on Excel offers a simple, cost-effective, and highly customizable solution. In this beginner’s guide, we’ll walk you through how to use Excel bookkeeping software, featuring tools and template from XcelBooks a leading name in spreadsheet-based accounting.

Why Choose Excel for Accounting?

Excel remains a favorite tool for bookkeeping due to its flexibility and familiarity. Unlike cloud-based platforms, Excel gives you complete control over your financial data. With the right structure, formulas, and template, Excel can handle tasks such as:

Expense tracking

Invoice generation

Profit & loss statements

Balance sheets

Tax calculations

That’s where XcelBooks comes in. This brand has developed pre-designed, easy-to-use Excel template specifically for bookkeeping and financial reporting.

Getting Started with XcelBooks

To use Excel bookkeeping software effectively, follow these beginner-friendly steps:

1. Customize Basic Information

Before entering any financial data, personalize the template with your business name, logo, contact details, and currency preferences. This step helps in branding and ensures all reports look professional.

2. Enter Financial Transactions

Input your daily transactions including income, expenses, and invoices. With accounting software on Excel, you can use automated categories and dropdowns to maintain consistency. Template by XcelBooks often include multiple sheets to keep records organized.

3. Automate Reports

One of the most powerful features of Excel bookkeeping software is automation. Most XcelBooks template come with built-in functions to automatically generate profit & loss statements, cash flow summaries, and monthly reports without needing to manually calculate totals.

4. Review and Back Up Your Data

Always double-check entries and formulas to ensure accuracy. It’s also a good practice to keep your Excel files backed up on cloud storage or external drives to avoid data loss.

Conclusion

If you're looking for a straightforward way to manage your finances, accounting software on Excel is a practical and accessible option. With tools like those from XcelBooks, even beginners can perform essential accounting tasks without prior experience.

Start small, grow with confidence, and enjoy the flexibility that Excel offers. Explore XcelBooks.com today to find the right Excel bookkeeping software that aligns with your business goals.

For more information, visit: https://xcelbooks.com/

0 notes

Text

How OGSCapital Handles Financial Forecasting: A Deep Dive

In the world of business planning, financial forecasting is one of the most critical—and often misunderstood—components. Whether you're trying to raise capital, apply for a loan, or simply create a roadmap for your startup, your ability to project future revenues, costs, and profitability is essential. It’s not just about numbers—it’s about telling a believable, data-driven story that investors and lenders can trust.

That’s where OGSCapital comes in.

Over the years, OGSCapital has earned a strong reputation for producing high-quality, investor-ready business plans. A consistent theme in every OGSCapital Review is their exceptional approach to financial forecasting—one that blends data analytics, market trends, and business modeling expertise to give clients a powerful advantage in funding discussions.

In this article, we’ll explore how OGSCapital handles financial forecasting and why their methodology continues to stand out in 2025.

1. The Importance of Accurate Financial Forecasting

Before diving into OGSCapital’s methods, it’s crucial to understand why forecasting matters. A well-crafted financial forecast gives stakeholders a clear picture of:

Revenue potential

Cost structure and operating expenses

Break-even timelines

Profitability estimates

Cash flow dynamics

Return on investment

Whether you’re talking to banks, venture capitalists, or grant committees, financial projections are often the first thing they scrutinize. Unrealistic or overly optimistic forecasts can immediately discredit your plan. OGSCapital Review Insight: Many client reviews highlight how OGSCapital helped them rethink and correct flawed assumptions in their original financial models, often resulting in stronger funding outcomes.

2. OGSCapital’s Approach to Financial Modeling Unlike many firms that rely on generic templates, OGSCapital builds custom financial models for each client based on the specifics of their industry, target market, and business structure. Here’s how their process typically unfolds:

a. Business Model Analysis OGSCapital consultants start by deeply understanding the client’s revenue streams, pricing models, cost structure, and scalability. For example, a subscription-based SaaS company will have a very different model than a brick-and-mortar restaurant or a medical services provider.

b. Industry Benchmarks and Market Data The team uses real-world data from sources like IBISWorld, Statista, and industry-specific databases to inform assumptions. These include average margins, customer acquisition costs, churn rates, and seasonality trends.

c. Realistic Assumptions OGSCapital avoids exaggerated projections. They build conservative, middle-ground, and aggressive forecasts to show a range of outcomes, which gives funders a better understanding of risk and potential upside.

d. Dynamic 3–5 Year Projections Standard forecasts typically include:

Monthly/quarterly revenue and costs

Gross and net profit margins

Detailed operating expense breakdowns

Cash flow statements

Balance sheets

Break-even analysis

Key financial ratios

Each forecast is structured using Microsoft Excel or Google Sheets, allowing clients to easily tweak variables and run different scenarios as needed.

3. Customization by Business Type and Funding Goal

OGSCapital doesn’t believe in a one-size-fits-all approach. They tailor financial forecasts based on both the industry and the type of funding the client is pursuing.

a. For Startups and Venture Capital These forecasts focus on growth trajectories, scalability, unit economics, and long-term profitability. VCs are particularly interested in:

Customer Lifetime Value (CLV)

Customer Acquisition Cost (CAC)

Burn rate

Runway and milestones

b. For Bank or SBA Loans Banks care about repayment ability and risk. OGSCapital builds conservative models that focus on:

Debt coverage ratios

Collateral value

Monthly cash flow

Profit stability

c. For Immigration and E2/EB5 Visas Here, projections focus on job creation, economic impact, and business viability. OGSCapital ensures the financial section aligns with immigration legal standards. OGSCapital Review Highlight: Several entrepreneurs applying for E2 visas mention that OGSCapital’s accurate and USCIS-compliant forecasts helped their applications sail through immigration processes smoothly.

4. Built-In Risk Assessment and Scenario Planning

Investors want to know: What happens if things don’t go as planned? OGSCapital addresses this through scenario analysis, which includes:

Best-case, worst-case, and base-case projections

Sensitivity analysis on key variables like pricing, costs, and churn

Identification of financial breakpoints and tipping points

This approach helps mitigate concerns about risk and shows that the client has a thoughtful understanding of their business environment. OGSCapital Review Note: Many clients share that presenting this range of financial scenarios gave them a noticeable edge during investor presentations and loan interviews.

5. Transparent Assumptions and Financial Storytelling

Numbers alone don’t secure funding--context does. OGSCapital makes it a point to include clear assumptions and justifications for every line item in the forecast. This is often placed in the appendix or explained in the financial narrative section. Key questions answered include:

Why do you expect this level of revenue in year 1?

What’s the basis for your pricing?

How will your marketing spend translate into customer growth?

Are your labor costs and overhead realistic?

Their storytelling ensures that the financial forecast supports the overall business case rather than existing in isolation.

6. Collaboration and Revisions Clients aren’t left out of the forecasting process. OGSCapital’s team works closely with clients through multiple rounds of revision to ensure the forecast aligns with:

Personal vision

Operational realities

Strategic goals

This collaborative approach helps clients understand and own their financials, which is crucial when speaking with funders. OGSCapital Review Summary: Several reviewers mention how responsive and thorough the consultants were when refining their forecasts, often explaining the logic behind changes and helping clients feel more confident about presenting the numbers.

7. Real-World Success Stories

OGSCapital’s financial forecasting isn’t just theoretical—it’s proven to work. Here are a few outcomes shared in public OGSCapital reviews:

A healthcare startup secured $850,000 in funding after presenting OGSCapital’s forecasts to a VC panel.

A retail franchise obtained a six-figure SBA loan, citing the “professional and convincing” financials as a key factor.

An international e-commerce company used OGSCapital’s model to guide internal decisions and raise Series A capital.

These successes stem from the company’s deep understanding of what funders are really looking for—and how to deliver it.

Conclusion: Why OGSCapital’s Financial Forecasting Gets Results

In a funding environment where investors and lenders are more cautious than ever, financial forecasting isn’t optional—it’s essential. OGSCapital’s unique blend of custom modeling, industry expertise, scenario planning, and clear storytelling gives clients a competitive edge.

From startups to franchises, from immigration cases to IPO-bound ventures, OGSCapital consistently produces financial forecasts that aren’t just accurate—they’re compelling.

If you’ve read any recent OGSCapital Review, you’ll notice one thing in common: clients walk away not only with polished numbers, but also with greater clarity, confidence, and funding success.

0 notes

Text

Financial Modeling in the Age of AI: Skills Every Investment Banker Needs in 2025

In 2025, the landscape of financial modeling is undergoing a profound transformation. What was once a painstaking, spreadsheet-heavy process is now being reshaped by Artificial Intelligence (AI) and machine learning tools that automate calculations, generate predictive insights, and even draft investment memos.

But here's the truth: AI isn't replacing investment bankers—it's reshaping what they do.

To stay ahead in this rapidly evolving environment, professionals must go beyond traditional Excel skills and learn how to collaborate with AI. Whether you're a finance student, an aspiring analyst, or a working professional looking to upskill, mastering AI-augmented financial modeling is essential. And one of the best ways to do that is by enrolling in a hands-on, industry-relevant investment banking course in Chennai.

What is Financial Modeling, and Why Does It Matter?

Financial modeling is the art and science of creating representations of a company's financial performance. These models are crucial for:

Valuing companies (e.g., through DCF or comparable company analysis)

Making investment decisions

Forecasting growth and profitability

Evaluating mergers, acquisitions, or IPOs

Traditionally built in Excel, models used to take hours—or days—to build and test. Today, AI-powered assistants can build basic frameworks in minutes.

How AI Is Revolutionizing Financial Modeling

The impact of AI on financial modeling is nothing short of revolutionary:

1. Automated Data Gathering and Cleaning

AI tools can automatically extract financial data from balance sheets, income statements, or even PDFs—eliminating hours of manual entry.

2. AI-Powered Forecasting

Machine learning algorithms can analyze historical trends and provide data-driven forecasts far more quickly and accurately than static models.

3. Instant Model Generation

AI assistants like ChatGPT with code interpreters, or Excel’s new Copilot feature, can now generate model templates (e.g., LBO, DCF) instantly, letting analysts focus on insights rather than formulas.

4. Scenario Analysis and Sensitivity Testing

With AI, you can generate multiple scenarios—best case, worst case, expected case—in seconds. These tools can even flag risks and assumptions automatically.

However, the human role isn't disappearing. Investment bankers are still needed to define model logic, interpret results, evaluate market sentiment, and craft the narrative behind the numbers.

What AI Can’t Do (Yet): The Human Advantage

Despite all the hype, AI still lacks:

Business intuition

Ethical judgment

Client understanding

Strategic communication skills

This means future investment bankers need a hybrid skill set—equally comfortable with financial principles and modern tools.

Essential Financial Modeling Skills for 2025 and Beyond

Here are the most in-demand skills every investment banker needs today:

1. Excel + AI Tool Proficiency

Excel isn’t going anywhere, but it’s getting smarter. Learn to use AI-enhanced functions, dynamic arrays, macros, and Copilot features for rapid modeling.

2. Python and SQL

Python libraries like Pandas, NumPy, and Scikit-learn are used for custom forecasting and data analysis. SQL is crucial for pulling financial data from large databases.

3. Data Visualization

Tools like Power BI, Tableau, and Excel dashboards help communicate results effectively.

4. Valuation Techniques

DCF, LBO, M&A models, and comparable company analysis remain core to investment banking.

5. AI Integration and Prompt Engineering

Knowing how to interact with AI (e.g., writing effective prompts for ChatGPT to generate model logic) is a power skill in 2025.

Why Enroll in an Investment Banking Course in Chennai?

As AI transforms finance, the demand for skilled professionals who can use technology without losing touch with core finance principles is soaring.

If you're based in South India, enrolling in an investment banking course in Chennai can set you on the path to success. Here's why:

✅ Hands-on Training

Courses now include live financial modeling projects, AI-assisted model-building, and exposure to industry-standard tools.

✅ Expert Mentors

Learn from professionals who’ve worked in top global banks, PE firms, and consultancies.

✅ Placement Support

With Chennai growing as a finance and tech hub, top employers are hiring from local programs offering real-world skills.

✅ Industry Relevance

The best courses in Chennai combine finance, analytics, and AI—helping you become job-ready in the modern investment banking world.

Whether you're a student, working professional, or career switcher, investing in the right course today can prepare you for the next decade of finance.

Case Study: Using AI in a DCF Model

Imagine you're evaluating a tech startup for acquisition. Traditionally, you’d:

Download financials

Project revenue growth

Build a 5-year forecast

Calculate terminal value

Discount cash flows

With AI tools:

Financials are extracted via OCR and organized automatically.

Forecast assumptions are suggested based on industry data.

Scenario-based DCF models are generated in minutes.

You spend your time refining assumptions and crafting the investment story.

This is what the future of financial modeling looks like—and why upskilling is critical.

Final Thoughts: Evolve or Be Left Behind

AI isn’t the end of financial modeling—it’s the beginning of a new era. In this future, the best investment bankers are not just Excel wizards—they’re strategic thinkers, storytellers, and tech-powered analysts.

By embracing this change and mastering modern modeling skills, you can future-proof your finance career.

And if you're serious about making that leap, enrolling in an investment banking course in Chennai can provide the training, exposure, and credibility to help you rise in the AI age.

0 notes

Text

Automate Excel Reporting with Devant IT Solutions for Smarter Business Insights

At Devant IT Solutions, we help organizations automate Excel reporting to streamline data analysis and improve decision-making. Traditional manual reporting is time-consuming, error-prone, and lacks real-time insights. Our automated Excel solutions eliminate repetitive tasks by integrating data from multiple sources into dynamic, customizable reports and dashboards. Whether you’re managing financial statements, sales data, or HR metrics, our automation tools ensure accuracy, consistency, and faster reporting cycles—all within the familiar Excel environment.

With Devant’s expertise, businesses gain access to intelligent templates, scheduled reporting, conditional formatting, and advanced visualization—all designed to save time and empower teams with actionable insights. Automation reduces human error, enhances collaboration, and provides key stakeholders with up-to-date information without the need for manual updates. Our solutions are fully tailored to meet industry-specific needs, whether you're a small business or a large enterprise. To explore how Devant can help your organization gain a competitive edge through efficient Excel reporting, please contact us

#real-time business intelligence#automated reporting#ai dashboard builder#transform excel data#devant#devantitsolution

0 notes

Text

Advanced Excel Course – Master the Tools Top Professionals Use Elevate your Excel skills and become a power user with our in-depth Advanced Excel course, designed for learners who are ready to move beyond the basics and tackle real-world data challenges.

Whether you're a working professional, a business owner, a student, or someone looking to upskill, this course is your gateway to becoming Excel-proficient in data analysis, automation, and reporting.

What You’ll Learn:

Master complex formulas like VLOOKUP, HLOOKUP, INDEX-MATCH, XLOOKUP, and dynamic arrays.

Understand nested IF statements, logical operators, and advanced cell referencing.

Create insightful dashboards using PivotTables, slicers, and PivotCharts.

Automate manual processes using Macros and foundational VBA scripting.

Leverage Power Query for data import, cleanup, transformation, and combination.

Use Power Pivot to model data from multiple sources and create powerful reports.

Implement data validation tools to control inputs and reduce human error.

Build interactive financial models, trackers, and custom templates.

Apply What-If Analysis, Solver, and Scenario Manager for smarter decision-making.

Use conditional formatting to highlight data trends, exceptions, and KPIs.

Explore advanced charting techniques to make your data presentations impactful.

Analyze large datasets efficiently using advanced filtering and dynamic ranges.

Learn keyboard shortcuts and productivity hacks to work faster in Excel.

Course Features:

100% recorded sessions – Learn at your own pace, on your schedule.

Step-by-step demonstrations with practical examples and downloadable files.

Lifetime access to all course content and future updates.

Certificate of completion to showcase your skills professionally.

Support via email or discussion forum for doubts and queries.

Suitable for Excel 2016, 2019, 2021 & Microsoft 365 versions.

Ideal for roles in data analysis, finance, HR, operations, sales, and consulting.

By the end of this course, you’ll confidently tackle advanced data tasks and streamline your workflow, helping you stand out in interviews, promotions, and high-impact projects.

Start learning today at www.mwcedu.com and transform your Excel skills into career assets.

#microsoft excel excel from beginner to advanced#advance excel course#advanced excel course online with certificate#advanced excel course online#advanced excel course with certification#excel beginner to advanced course#advance excel certification course#Oline learning platform

0 notes

Text

Excel for Accountants & Payroll: Advanced 2025 Guide

In the fast-paced world of finance and payroll, precision and efficiency are not just advantages—they’re necessities. As we navigate through 2025, one tool continues to dominate the back-end operations of businesses across the globe: Microsoft Excel. Despite newer tools entering the market, Excel remains the gold standard, especially for accounting and payroll professionals who rely on its flexibility and computational power to handle complex financial data.

However, Excel is no longer just about entering numbers into cells. Its advanced capabilities now allow for automation, data visualization, error tracking, and real-time financial analysis. That's exactly what this Advanced Excel Guide 2025 aims to help with—equipping accountants and payroll teams with the modern-day skills to do more in less time, and with greater accuracy.

Why Excel Still Reigns Supreme in Accounting and Payroll

The beauty of Excel lies in its versatility. Whether you’re working for a small business or part of a large enterprise payroll department, Excel can be scaled and tailored to your needs. From setting up employee pay structures and managing timesheets to forecasting budgets and generating financial statements, Excel is the ultimate companion for finance professionals.

With the 2025 updates and integrations, Excel has gone beyond the basics. Now, with powerful features like Power Query, XLOOKUP, dynamic arrays, and pivot charts, accountants can dive deeper into financial insights without relying on multiple software tools. Excel for Payroll isn’t just about calculations anymore—it’s about strategic analysis and decision-making, all happening in one robust spreadsheet.

Mastering Advanced Features in 2025

This year, the focus of many Excel upgrades is about making the tool smarter and more intuitive. For those pursuing an Excel course in 2025, the emphasis is on automation, error reduction, and efficiency. Advanced users are expected to go beyond SUM and VLOOKUP, diving into real-time dashboards, macros, and data modeling.

Understanding tools like Power Pivot is crucial for accountants who need to analyze large datasets quickly. Payroll professionals, meanwhile, benefit from learning IF statements, nested formulas, and conditional formatting, all of which help flag discrepancies, highlight patterns, and maintain consistency in payroll records.

With built-in templates and AI-assisted formula suggestions, Excel is becoming a proactive partner in your financial workflow rather than just a reactive tool. This shift makes learning from an advanced Excel guide all the more essential for staying relevant in the field.

Excel for Accountants: Going Beyond the Ledger

Accounting isn’t just about recording transactions—it’s about interpreting them. Excel gives accountants the power to visualize financial data with tools like charts, sparklines, and scenario managers. Imagine creating a monthly report where every key metric updates automatically when you change a single cell. That’s not just efficient; it’s transformational.

In the Excel guide 2025, special emphasis is placed on data validation, protection, and linked workbooks, which are essential for accountants handling sensitive or collaborative files. Also, auditing tools such as the formula tracer and watch window help reduce the risk of errors and improve overall financial integrity.

Today’s accountant needs to think like a data analyst. With Excel’s robust functionalities, you can forecast sales trends, model financial outcomes, and provide real-time insights to stakeholders—all without switching to different software.

Excel for Payroll: Automating the Repetitive

Payroll processing is one of the most repetitive yet critical functions within any HR or finance team. Mistakes here can lead to compliance issues, dissatisfied employees, and even legal troubles. That’s why modern payroll professionals are leaning heavily on Excel for Payroll automation.

In 2025, payroll experts are expected to understand how to set up dynamic pay scales, automate leave tracking, and generate tax summaries using Excel’s advanced features. Functions like TEXT, DATE, EOMONTH, and NETWORKDAYS are essentials for creating error-free, compliant pay reports.

Using pivot tables, payroll teams can instantly group and filter employee data across departments, track overtime trends, or assess bonus distributions. Excel’s macro recorder can automate the monthly salary sheet generation, saving hours of manual effort.

The Advanced Excel Guide 2025 places a clear focus on these automation techniques—helping professionals cut down on repetitive tasks and spend more time analyzing data for accuracy and trends.

Getting the Most Out of Excel Courses in 2025

If you’re serious about upskilling this year, enrolling in a structured Excel course is a smart move. But not all courses are created equal. The best programs in 2025 go beyond basic functions, offering real-world case studies that mirror the day-to-day work of accountants and payroll professionals.

Look for courses that include hands-on training in financial reporting, data modeling, and payroll scheduling. Learning how to build an interactive dashboard or automate monthly close processes can be a career-changer. Not only will it make your job easier, but it will also add tremendous value to your organization.

Today’s employers expect accountants and payroll managers to be self-sufficient with data tools. With the right Excel guide 2025, you can confidently step into that expectation and even go a step beyond.

Real-World Application of Advanced Excel Skills

Think of Excel not as a spreadsheet but as a business engine. Imagine you’re working in a midsize company and your monthly payroll file includes data for 500 employees. With the right formulas, you can calculate taxes, deductions, and net pay automatically. With pivot charts, you can provide HR with insights on salary distribution. And with data validation, you ensure no one enters invalid values or dates.

Similarly, in accounting, you can use Excel to build cash flow projections or break-even analyses using just a few linked sheets. Want to track financial KPIs or set up alerts when expenses exceed a threshold? Excel makes it possible—all with a bit of setup and understanding of its deeper features.

This is the power of Excel when it’s in the hands of a trained professional.

Why This Guide Matters in 2025 and Beyond

The need for accuracy, speed, and automation in finance roles has never been greater. As regulations evolve and business demands grow, accountants and payroll specialists can’t afford to stick with outdated methods. The Advanced Excel Guide 2025 is more than just a manual—it’s a strategic resource for professionals who want to elevate their roles and future-proof their careers.

By learning how to leverage the full capabilities of Excel, you not only enhance your individual productivity but also contribute to a more agile and responsive organization. Whether you’re generating payroll summaries, auditing financial statements, or analyzing expense patterns, Excel has the tools—you just need to know how to use them.

Conclusion: Step Into the Future of Finance with Excel

Excel isn’t just a spreadsheet; it’s your financial Swiss Army knife. With 2025’s features and advanced tools, it’s time to move beyond basics and embrace the power of smart spreadsheets. For accountants and payroll professionals alike, mastering Excel is no longer optional—it’s a competitive edge.

So, whether you’re self-taught, seeking formal training, or simply looking to refresh your skills, the Excel guide 2025 is your roadmap to a more productive, insightful, and efficient financial workflow.

Don’t just use Excel. Master it—and make 2025 your most productive year yet.

0 notes

Text

Free Balance Sheet Template for Income and Expenses

Managing your business finances can often feel overwhelming—especially for small business owners and self-employed entrepreneurs who juggle multiple roles. Whether you are tracking income, organizing expenses, or preparing for tax season, a clear and accurate financial picture is essential. One of the most powerful tools you can use is a balance sheet. With Otto AI’s free balance sheet template, you gain a simple, structured format to document your business’s financial standing—all at no cost.

In this blog, we will explore the importance of using a balance sheet, how a template can streamline your accounting process, and why Otto AI's balance sheet template download is an ideal choice for entrepreneurs and small business professionals.

Why Every Business Needs a Balance Sheet

A balance sheet is a financial statement that provides a snapshot of your business’s assets, liabilities, and equity at a given point in time. It helps you evaluate the financial health of your business, track growth, and prepare for conversations with investors or lenders.

For small business owners and freelancers, this tool is particularly valuable because it:

Offers a clear view of what the business owns and owes

Helps manage cash flow and budgeting

Prepares the foundation for financial planning

Serves as a critical part of the decision-making process

Keeps you ready for tax audits and loan applications

Without a reliable structure to record and review this information, it is easy to lose track of important financial details. That is where a free balance sheet template becomes extremely useful.

Benefits of Using a Balance Sheet Template

Manually creating a balance sheet can be time-consuming and prone to error. A balance sheet template download simplifies the process by providing a pre-designed format that ensures all necessary fields are included and consistently formatted.

With a free balance sheet template, you can:

Save time with a ready-to-use layout

Minimize errors by following a standard format

Get organized and stay compliant

Make more confident business decisions

Present your financials professionally to clients, lenders, or stakeholders

Otto AI understands the unique needs of small businesses and self-employed professionals. That is why its free balance sheet template is tailored to be simple, accurate, and compatible with multiple use cases.

Features of Otto AI’s Free Balance Sheet Template

When choosing a financial template, quality matters. Otto AI’s balance sheet template download offers several practical features to support your everyday financial tracking:

User-friendly format: Designed for business owners who may not have an accounting background

Editable and printable: Compatible with standard spreadsheet programs like Excel and Google Sheets

Detailed sections: Includes categories for current assets, long-term liabilities, owner equity, and more

Instant accessibility: No sign-up or payment required—just download and start using

Adaptable: Can be tailored to fit the needs of freelancers, consultants, e-commerce sellers, and service providers

These features make Otto AI’s free balance sheet template more than just a static document. It is a practical tool that supports long-term financial clarity.

How to Use the Otto AI Balance Sheet Template

Getting started with Otto AI’s template is easy and requires no special software or training. Here’s a simple step-by-step guide:

Download the template Visit https://joinotto.com/templates/balance-sheet and click to download the free balance sheet template.

Enter your business name and reporting date Make sure to set the timeframe so your financial snapshot is current and relevant.

Fill in your assets List your current and long-term assets. This can include cash, inventory, equipment, and accounts receivable.

Record liabilities Add both current liabilities (e.g., short-term loans, unpaid bills) and long-term debts.

Calculate equity The final section should show owner’s equity. This is calculated using the formula: Equity = Assets - Liabilities

Review and adjust Double-check all values for accuracy. Use the template monthly or quarterly to track changes over time.

Whether you manage your own books or work with a tax advisor, this structure simplifies everything.

Why Small Businesses Trust Otto AI

Otto AI is not just another template provider. It is a platform built with the small business owner and solo entrepreneur in mind. The brand stands for simplicity, clarity, and function—values that are especially important when managing finances.

Otto AI’s free balance sheet template is a reflection of that mission. It helps business owners like you take control of your numbers without the hassle of complex software or overwhelming spreadsheets. The balance sheet template download is just one of many tools Otto AI provides to support financial success across all industries and business sizes.

When to Update Your Balance Sheet

Keeping your balance sheet up to date is key to maintaining a strong financial strategy. While some businesses do this quarterly, others update it monthly—especially during growth periods or when applying for credit.

As a small business or self-employed entrepreneur, you should update your balance sheet when:

Major purchases are made

Loans are taken or paid off

Inventory levels change significantly

Income or client volume shifts dramatically

Using Otto AI’s template regularly keeps your financial documentation accurate and actionable.

Final Thoughts

In the world of business, staying financially organized is not optional—it is essential. A balance sheet offers a clear, objective look at your business’s standing, and using a well-designed template can save time and prevent costly mistakes.

With Otto AI’s free balance sheet template, you gain access to a dependable tool that supports your success without unnecessary complexity. Whether you are just starting or scaling your operations, this balance sheet template download provides the structure you need to move forward confidently.

Visit https://joinotto.com/templates/balance-sheet today to download your free template and start building a stronger financial foundation with Otto AI.

0 notes

Text

Open Efficiency: The Best Free Medical Billing Software of 2023 for Your Practice

unlock Efficiency: The best Free Medical Billing Software of 2023 for Yoru Practice

In today’s fast-paced healthcare environment, effective medical billing is crucial for maintaining the financial health of your practice. As medical professionals strive to provide excellent patient care, having the right tools becomes essential. Enter free medical billing software! in this article, we’ll explore the best free medical billing software of 2023 designed to streamline your billing processes and boost your practice’s efficiency.

Why Use Medical Billing Software?

Using medical billing software has several benefits that can significantly enhance the operational efficiency of your practice.Here are a few key advantages:

Increased Efficiency: Automate billing processes to save time and reduce manual errors.

Improved Accuracy: Minimize billing mistakes and reduce claim denials.

Better Cash Flow: Expedite collections and improve overall revenue cycle management.

Enhanced Reporting: Utilize data analytics to track financial performance and patient history.

Key Features to Look for in Free Medical Billing Software

when selecting free medical billing software, it’s crucial to consider features that align with your practice’s specific needs. Here are the critical features to look for:

Insurance claim management

patient invoicing and billing statements

Payment tracking and management

Reporting and analytics capabilities

User-kind interface and multi-user support

The Best Free Medical Billing Software of 2023

Below are some of the top free medical billing software options available in 2023,along with their highlights and features.

Software

Features

Best For

Wave

Invoicing, Payment processing, Reporting

Small Practices

PracticeSuite

Claims management, Patient billing, Scheduling

Mid-Sized Practices

DrChrono

EHR integration, Claim tracking, Patient payments

All Sizes

Kareo

Billing, Scheduling, Patient management

Small to Medium Practices

Ace Health

Customizable templates, Analytics, Electronic claims

Startups

In-depth Review of Top Medical Billing software

1. Wave

Wave is a powerful, extensive free billing software ideal for small practices. It offers essential features like invoicing, payment processing, and reporting. The intuitive interface allows for easy navigation, making it a go-to solution for beginners.

2. PracticeSuite

PracticeSuite excels in claims management and patient billing, making it a great choice for mid-sized practices. Its built-in analytics tools help you track financial performance and identify trends in patient payments.

3. DrChrono

DrChrono provides healthcare practices with a comprehensive solution by integrating EHR with billing functionalities.Claim tracking and patient payments are seamlessly managed, making it suitable for practices of all sizes.

4. Kareo

Kareo is a cloud-based solution that focuses on billing, scheduling, and patient management. It offers a range of features, making it adaptable to both small and medium-sized practices.

5.ace Health

Ace Health stands out with its customizable templates and robust analytics capabilities. It’s particularly useful for startups looking to manage their finances flexibly and efficiently.

Benefits of Using Free Medical Billing Software

��� The use of free medical billing software can bring several tangible benefits to your practice:

Cost-Effectiveness: Save on expensive billing solutions while still getting robust features.

User-Friendly: Most free options are designed for ease of use,minimizing the learning curve.

Scalability: Many platforms allow you to upgrade as your practice grows, providing future-proof solutions.

Tips for Effective Implementation

Successfully implementing medical billing software into your practice can be streamlined by following these tips:

Choose the Right Software: Consider your specific needs before selecting a platform.

Train Your Staff: Ensure that all staff members understand how to use the software effectively.

Regular Updates: Keep your software updated to improve performance and security.

Monitor Performance: Regularly review your billing processes and make adjustments as needed.

Conclusion

Investing in free medical billing software is a smart move for healthcare practices looking to enhance their billing processes without incurring additional costs. The options available in 2023, including Wave, PracticeSuite, DrChrono, Kareo, and ace Health, provide excellent features tailored to different practice sizes. By choosing the right software and implementing it effectively, you can unlock efficiency in your practice and ensure a better financial outcome.

Remember, the key to maximizing the benefits lies in regular monitoring and refining your approach. Embrace technology to streamline your medical billing and focus on what you do best – providing exceptional care to your patients!

youtube

https://medicalcodingandbillingclasses.net/open-efficiency-the-best-free-medical-billing-software-of-2023-for-your-practice/

0 notes

Text

Streamline Your Finances with Expert Odoo Accounting Solutions by Banibro IT Solutions

In the bustling economic hub of Dubai, efficient financial management is the backbone of business success. Odoo Accounting, a core module of the Odoo ERP ecosystem, empowers organizations to automate financial workflows, ensure compliance, and gain real-time insights into their fiscal health. As an , Banibro IT Solutions specializes in implementing tailored Odoo Accounting solutions that simplify complexity, reduce errors, and drive profitability. Whether you’re a startup or an enterprise, our expertise ensures your accounting processes are as agile as your ambitions.

Why Odoo Accounting?

Odoo Accounting stands out for its intuitive design, automation capabilities, and seamless integration with other business functions. Unlike traditional accounting software, it offers:

End-to-End Financial Management: From invoicing and expense tracking to multi-currency reconciliation and tax compliance.

Real-Time Reporting: Instant access to cash flow statements, balance sheets, and profit & loss reports.

Scalability: Adapt to growing transaction volumes, new markets, or regulatory changes effortlessly.

At Banibro IT Solutions, we enhance these features with industry-specific customization and unwavering support.

Expert Odoo Accounting Features Delivered by Banibro IT Solutions

Automated Invoicing & Payments

Generate and send invoices automatically based on sales orders or project milestones.

Set up online payment gateways (e.g., PayPal, Stripe) for faster collections and reduced delays.

Schedule recurring invoices for subscriptions or retainer clients.

Multi-Currency & Multi-Company SupportManage transactions in AED, USD, EUR, or other currencies with real-time exchange rate updates. Consolidate financials across subsidiaries or branches seamlessly.

Tax Compliance Made Simple

Automate VAT calculations for UAE compliance, including VAT returns and filing.

Configure tax rules for international operations to avoid penalties.

Expense Tracking & Approval Workflows

Capture employee expenses via mobile apps, receipts, or email.

Implement multi-level approval workflows to ensure policy adherence.

Bank ReconciliationSync Odoo with your bank feeds to reconcile transactions in minutes, not hours.

Advanced Financial Analytics

Custom dashboards to monitor KPIs like gross margins, DSO (Days Sales Outstanding), or budget variances.

Drill-down reports for granular insights into departmental spending or revenue streams.

Integration with Odoo Modules

Sales & Inventory: Auto-update COGS (Cost of Goods Sold) and track profitability per product.

HR & Payroll: Sync employee data for accurate payroll processing and labor cost analysis.

Project Management: Allocate project costs and track ROI in real time.

Banibro’s Odoo Accounting Implementation Process

We ensure a frictionless transition to Odoo Accounting with a structured approach:

Business Process ReviewAnalyze your current financial workflows, pain points, and compliance requirements.

Tailored Configuration

Chart of Accounts: Set up accounts aligned with UAE standards or global IFRS.

Automation Rules: Configure recurring journals, payment reminders, or tax templates.

Third-Party Integrations: Connect with banking APIs, payroll systems, or CRM tools.

Data MigrationSecurely transfer historical data (e.g., invoices, ledgers) from legacy systems like QuickBooks, Tally, or Excel.

User TrainingEmpower your finance team with hands-on training on Odoo’s accounting features, from basic bookkeeping to advanced reporting.

Go-Live & OptimizationLaunch with minimal disruption, supported by our team to fine-tune workflows and resolve initial challenges.

Ongoing Odoo Accounting Support by Banibro IT Solutions

Our partnership ensures your accounting system evolves with your business:

24/7 Technical Support: Resolve issues like reconciliation errors or integration glitches promptly.

Regulatory Updates: Stay compliant with UAE VAT, ESR (Economic Substance Regulations), or global tax laws through automatic updates.

Performance Audits: Quarterly reviews to optimize processes, reduce costs, and enhance accuracy.

Scalability Upgrades: Add advanced features like budget forecasting, asset management, or consolidated reporting as needed.

Case Study: Boosting Financial Efficiency with Odoo Accounting

Automated invoice generation from delivery orders.

Bank feed integration for real-time reconciliation.

Custom dashboards to track cash flow and overdue payments. Results: 60% faster invoice processing, 90% reduction in reconciliation errors, and improved VAT compliance.

Why Partner with Banibro IT Solutions for Odoo Accounting?

Odoo Gold Partner: Certified expertise in financial module customization and compliance.

Industry-Specific Expertise: Tailored solutions for retail, construction, hospitality, and trading sectors.

Local Knowledge: Deep understanding of UAE’s tax landscape and business practices.

Transparent Pricing: Flexible packages with no hidden fees—scale as your needs grow.

Ready to Modernize Your Financial Management?

Don’t let manual processes or outdated software hinder your growth. With Banibro IT Solutions , transform your accounting operations into a strategic asset using Odoo’s powerful tools.

📞 Contact Us Today!Schedule a free Odoo Accounting demo or consultation to discover how we simplify finance for your business.

Banibro IT Solutions – Where Precision Meets Productivity.

0 notes

Text

Cash Flow Statement Template for Startups and Entrepreneurs

Effective financial management is the cornerstone of any successful business, and tracking cash flow is one of its most vital components. A well-structured cash flow statement template helps business owners and finance managers monitor the inflow and outflow of cash, ensuring that the company maintains a healthy liquidity position. However, creating this statement from scratch can be time-consuming and error-prone—especially for small businesses and startups with limited resources. This is where a reliable and free cash flow statement template becomes invaluable.

Why Cash Flow Matters

Unlike profit, which can be influenced by non-cash factors like depreciation and accruals, cash flow shows the actual movement of money in and out of your business. A cash flow statement provides a clear picture of a company’s ability to pay bills, invest in growth, and weather financial storms. It is often divided into three main sections:

Operating Activities – cash generated or used from core business operations.

Investing Activities – cash used for purchasing assets or received from investments.

Financing Activities – cash received from or paid to lenders and investors.

By analyzing these areas, businesses can detect potential cash shortages before they become critical and make better strategic decisions.

Features of a Great Free Cash Flow Template

The best free cash flow statement templates are not only easy to use but also customizable and detailed enough to provide valuable insights. Key features to look for include:

Pre-formatted categories for income and expenses

Automated calculations to reduce errors and save time

Monthly, quarterly, or annual breakdowns

Graphs or visual aids to help spot trends quickly

Editable fields that allow flexibility as your business grows

Top Free Cash Flow Statement Templates

Microsoft Excel Cash Flow Template

Available for free on Microsoft’s official template library

Easy to customize and includes sections for all three cash flow activities

Perfect for small businesses and freelancers

Google Sheets Cash Flow Template

Ideal for collaborative teams and remote finance tracking

Free and cloud-based, with auto-saving and sharing features

Can be integrated with Google Forms and other apps for dynamic updates

Smartsheet Cash Flow Statement

Offers a user-friendly interface with powerful features

Includes pre-built templates for operational cash flow management

While Smartsheet has a paid version, many templates are free

Vertex42 Cash Flow Template

Created by a well-known provider of Excel templates

Includes comprehensive monthly cash flow tracking

Good for startups and personal finance tracking

Final Thoughts

Tracking your cash flow doesn’t have to be a daunting task. With the right free cash flow statement template, even businesses with minimal accounting knowledge can stay on top of their finances. Whether you prefer Excel, Google Sheets, or another platform, these templates offer the tools needed for accurate and insightful financial tracking. By making cash flow management easy and accessible, these templates empower businesses to make informed decisions and plan for long-term success.

1 note

·

View note

Text

Get on-demand premium quality personalized letter printing and mailing solutions

In today’s fast-paced, customer-first world, personalized communication can be a game-changer for your business. Whether you're sending client welcome kits, legal notices, marketing letters, or billing statements, on-demand letter printing and mailing solutions allow you to do it all—efficiently and professionally.

This guide explores how businesses of all sizes can benefit from premium, personalized letter printing and mailing services, and why on-demand fulfillment is the new standard for operational efficiency and customer satisfaction.

What Are On-Demand Letter Printing and Mailing Solutions?

These services allow businesses to create, print, personalize, and mail letters or documents as needed, without dealing with traditional printing logistics.

You simply upload or integrate your data, and the provider:

Generates personalized letters

Prints them using professional-grade printers

Inserts them into envelopes

Delivers them through postal services—national or international

All of this can be done without you ever leaving your desk.

Why Choose On-Demand Over Traditional Methods?

1. No Inventory or Bulk Printing

Print what you need, when you need it. Avoid waste and storage costs.

2. Fast Turnaround

Letters can be printed and mailed same-day or next-day, ideal for urgent documents.

3. High-Level Personalization

Tailor each letter using dynamic fields—names, locations, account details, and more.

4. Secure & Compliant

Top providers follow data security and compliance standards like SOC 2, HIPAA, or GDPR.

5. Nationwide & Global Delivery

Reach your customers anywhere with verified address validation and real-time tracking.

Key Features to Look For

Web-Based Dashboard or API Access

Automated Data Imports (from Excel, CRMs, or ERPs)

Variable Data Printing (VDP)

Letter Templates and Custom Branding

Print Proofing and Audit Trails

Certified Mail, Priority Mail, and International Options

Types of Letters You Can Send

Marketing & Promotional Letters

Customer Notifications

Legal Notices

Financial Statements

Welcome Letters

Policy Updates

Fundraising Appeals

Invoices & Receipts

Whether it’s 1 letter or 10,000, on-demand platforms scale effortlessly.

Top Industries Using On-Demand Printing & Mailing

Legal & Law Firms

Banks & Financial Institutions

Healthcare Providers

Insurance Companies

Government & Municipalities

SaaS & Subscription Services

Ecommerce & Retail

Each industry values accuracy, speed, and professionalism, which on-demand solutions deliver every time.

The Importance of Quality in Letter Printing

Premium quality doesn’t just mean nice paper. It’s about:

Laser-sharp printing

Tamper-proof envelopes

Color options for logos or charts

Professional presentation that reflects your brand

High-quality letters build trust, engagement, and credibility—especially when communicating important information.

How to Personalize Letters for Maximum Impact

Use Variable Data Fields Insert first names, account numbers, or recent transactions.

Segment Your Audience Create different versions of letters for different customer types.

Add QR Codes or Unique URLs Drive offline recipients to personalized landing pages or forms.

Include Signatures or Stamps Add a human touch or official authenticity.

Trigger Letters Based on Actions Automate mailing when someone signs up, purchases, or reaches a milestone.

Choosing the Right Service Provider

When selecting a letter printing and mailing provider, look for:

Speed & Fulfillment Guarantees

Quality Control Processes

Real-Time Status Updates

Address Validation

Flexible Templates

Integrations with your CRM or ERP

Enterprise Security Certifications

Popular Platforms That Offer On-Demand Mailing Services

Mailform

LetterStream

Click2Mail

Postalytics

PostGrid

Lob

Inkit

Each offers a mix of manual uploads, API integrations, and bulk options.

Sustainability and Eco-Friendly Printing

Many modern providers use:

FSC-certified paper

Eco-friendly inks

Carbon-neutral delivery options

Digital workflow to reduce paper waste

Going green with mail? It’s easier than ever.

Conclusion: Get Started with On-Demand Letter Mailing

If you're still relying on in-house teams or local printers to send your business letters, it’s time to upgrade. On-demand, personalized printing and mailing isn’t just more convenient—it’s more scalable, secure, and impactful.

From high-volume campaigns to one-off notifications, these solutions deliver premium quality and timely delivery every time.

youtube

SITES WE SUPPORT

API To Print Direct Mails – Wix

1 note

·

View note

Text

Abhay Bhutada’s ₹241 Crore Salary Redefines Executive Leadership in India

When Abhay Bhutada, of the Poonawalla Group, received a ₹241 crore remuneration in FY24, it wasn’t just a personal achievement—it was a statement about the changing tides of Indian business. This record-breaking figure, the highest ever for a non-promoter executive in a publicly listed Indian company, reflects a broader shift in how corporate India values professional leadership. Unlike traditional compensation structures dominated by promoter-CEOs, Bhutada’s package was heavily tied to performance-linked stock options, underscoring a growing emphasis on meritocratic reward systems.

Also Read: Shaping the Future Through Leadership

The Performance Behind the Paycheck

Bhutada’s compensation wasn’t just about holding a title—it reflected the significant impact he delivered. Under his leadership, a conventional NBFC was transformed into a digitally advanced financial institution. The organization witnessed remarkable growth in assets under management while maintaining one of the lowest levels of non-performing assets in the sector. Most notably, its stock delivered near-triple-digit returns since its 2021 IPO, underscoring Bhutada’s sharp strategic direction and execution.

His approach combined innovation with prudence. While competitors chased reckless growth, Bhutada focused on sustainable scaling, leveraging technology to streamline operations without compromising risk management. This balance between ambition and discipline became a hallmark of his leadership—and a key reason why his exit, despite being a retirement, sent ripples through the financial sector.

Beyond Business: The Philanthropic Counterbalance

What makes Abhay Bhutada’s story compelling isn’t just the size of his paycheck, but how he has chosen to deploy his success. Through the Abhay Bhutada Foundation, he has directed resources toward education and healthcare in underserved communities. Recent initiatives, such as distributing STEM kits to rural schools near Pune, highlight a commitment to bridging opportunity gaps. In an era where wealth accumulation often overshadows wealth redistribution, Bhutada’s dual focus on corporate achievement and social impact offers a nuanced model of leadership.

Also Read: A Legacy of Innovation, Business Excellence, and Giving Back

A New Template for Executive Rewards

Abhay Bhutada's salary package signals a departure from old norms. For years, India’s highest-paid executives were almost exclusively promoter-CEOs—entrepreneurs who built and owned their companies. Today, professional managers like Bhutada are breaking into that upper echelon, proving that leadership, not just ownership, can drive extraordinary value. This shift aligns with global trends, where performance-linked incentives dominate executive pay structures.

The implications are profound. If this model gains traction, it could redefine career trajectories for India’s managerial talent, incentivizing long-term thinking and accountability. It also places pressure on boards to design compensation frameworks that truly align leadership incentives with sustainable growth—not just short-term stock pops.

Also Read: India’s Highest-Paid Executive Abhay Bhutada and His Mission to Uplift Lives

The Road Ahead

While Bhutada’s payday sets a new benchmark, its true significance lies in what it represents: a maturation of India’s corporate culture. As more companies embrace performance-based compensation, the divide between professional executives and promoter-CEOs may blur further. The challenge now is ensuring that such rewards remain tied to genuine value creation—not just financial engineering.

Ultimately, Bhutada’s legacy isn’t just about the ₹241 crore figure. It’s about proving that in the new Indian economy, visionary leadership can be as valuable as capital itself. And for aspiring executives, that’s a precedent worth celebrating.

1 note

·

View note

Text

Accounting Software for Indian Businesses: Top GST Compliant Solutions in 2025

As India continues to grow as one of the world’s largest economies, the need for efficient financial management has become even more critical for businesses. The introduction of the Goods and Services Tax (GST) in India has further emphasized the need for businesses to use software solutions that comply with the ever-evolving tax regulations. To help business owners and accountants navigate this complex landscape, we’ve compiled a list of the Top GST-compliant Accounting Software solutions available in 2025. These tools will ensure that your business remains compliant, reduces manual errors, and streamlines financial processes.

Why GST Compliance is Crucial for Indian Businesses?

GST compliance is essential for businesses operating in India due to the complexity of the tax system. Non-compliance can result in penalties, fines, and potential legal action. Using accounting software that integrates GST features simplifies the invoicing process, automates tax calculations, and ensures your business remains compliant with the latest GST laws.

Key Features to Look for in GST-Compliant Accounting Software

When selecting GST-compliant accounting software for your business, ensure that the solution offers the following features:

GST Tax Calculation: Automatically calculates GST based on your sales and purchase transactions.

GST Return Filing: Supports GST return generation and filing, including GSTR-1, GSTR-2, and GSTR-3B.

Invoice Generation: Allows the creation of professional, GST-compliant invoices.

Real-time Updates: Provides updates on any changes to GST laws and regulations.

Multi-User Support: Enables multiple users to access and collaborate on financial data.

Customizable Reports: Generates tax reports, financial summaries, and profit/loss statements.

Top GST-Compliant Accounting Software Solutions in 2025

Here are the top accounting software tools that are not only GST-compliant but also offer a range of features to enhance your financial management in 2025:

1. Smaket GST Billing Software

OverviewSmaket is one of the most advanced and user-friendly GST-compliant billing software solutions available today. It’s designed to simplify accounting for Indian businesses by automating GST calculations and invoicing processes.

Key Features

GST-compliant invoicing and auto-calculation

Multi-currency support for global transactions

Real-time GST return filing for GSTR-1, GSTR-2, and GSTR-3B

Invoice tracking and payment reminders

Customizable invoice templates to reflect your branding

Automatic tax updates in line with the latest GST laws

Why Smaket?Smaket is perfect for small and medium-sized businesses looking for a seamless solution that integrates invoicing, GST compliance, and accounting features. The software’s simplicity and intuitive interface make it an excellent choice for entrepreneurs who need an efficient way to manage their taxes and finances.

2. TallyPrime

OverviewTallyPrime is a well-known accounting software that has been a reliable choice for Indian businesses for years. With GST compliance features and strong accounting capabilities, TallyPrime is suitable for both small and large businesses.

Key Features

GST-compliant invoicing with auto tax calculation

GST return filing (GSTR-1, GSTR-2, GSTR-3B)

Comprehensive inventory management

Multi-location and multi-currency support

Detailed financial reports, including profit and loss statements

Multi-user support with role-based access control

Why TallyPrime?TallyPrime is highly regarded for its flexibility and robust accounting features. It’s ideal for businesses that need a comprehensive accounting solution that goes beyond GST compliance, making it a top choice for large enterprises.

3. Zoho Books

OverviewZoho Books is a cloud-based accounting software solution that offers a range of features designed to make GST compliance easier for businesses. It’s particularly well-suited for freelancers, small businesses, and startups.

Key Features

GST-compliant invoicing and automated tax calculation

Seamless GST return filing (GSTR-1, GSTR-3B)

Bank reconciliation and online payment integration

Detailed financial reports and insights

Multi-currency support for global clients

Integrates with other Zoho products, such as Zoho CRM and Zoho Inventory

Why Zoho Books?Zoho Books is ideal for small businesses and startups that need a cloud-based solution to manage their finances. Its user-friendly interface, along with its integration capabilities, makes it a great choice for businesses that need flexibility and scalability.

4. QuickBooks India

OverviewQuickBooks is a popular accounting solution globally, and its India-specific version is fully GST-compliant. It’s an excellent tool for small to medium-sized businesses looking for an easy-to-use accounting and tax solution.

Key Features

GST-compliant invoicing and tax calculations

GST return filing for GSTR-1, GSTR-3B, and GSTR-9

Automatic tax updates based on the latest GST laws

Multi-user support for teams and accountants

Automatic bank feeds for easy reconciliation

Customizable reports for tax and financial analysis

Why QuickBooks India?QuickBooks India is ideal for businesses looking for a straightforward, user-friendly accounting tool with powerful features. Its cloud-based nature and integration with other platforms, like PayPal and Stripe, make it a convenient option for businesses of all sizes.

5. Marg ERP 9+

OverviewMarg ERP 9+ is a complete business management software that caters to GST-compliant invoicing, accounting, and inventory management. It is widely used across various industries, including manufacturing, retail, and distribution.

Key Features

GST-compliant invoicing and automated tax calculations

Multi-warehouse and multi-location inventory management

GST return filing, including GSTR-1, GSTR-2, and GSTR-3B

Customizable reports for financial tracking

Barcode integration for inventory management

Easy integration with e-commerce platforms like Amazon and Flipkart

Why Marg ERP 9+?Marg ERP 9+ is an ideal solution for businesses that require advanced features like inventory management and e-commerce integration, along with GST compliance. Its ability to handle complex business processes makes it perfect for manufacturers, wholesalers, and distributors.

Conclusion

In 2025, GST-compliant accounting software is a must for every business operating in India. The solutions listed above, such as Smaket, TallyPrime, and Zoho Books, ensure that businesses not only stay compliant with GST laws but also streamline their accounting processes for better efficiency and accuracy.

Choosing the right accounting software depends on the size and complexity of your business. Whether you’re a freelancer, a startup, or a large enterprise, there is a GST-compliant software solution that can meet your needs. Make sure to choose a solution that offers real-time updates, customizable invoicing, and integrates seamlessly with your other business systems.

0 notes

Text

How Generative AI is Revolutionizing Financial Modeling in Investment Banking

Investment banking has always been about precision, speed, and strategic decision-making. At the heart of this industry lies financial modeling—the art and science of translating raw data into insights that can make or break multi-million-dollar deals. But as the complexity of markets grows, so does the need for better, faster tools.

Enter Generative AI—the latest technological leap that’s turning heads across global investment firms. While artificial intelligence has already made waves in areas like algorithmic trading and credit risk assessment, Generative AI is now poised to transform how investment bankers create and interpret financial models.

And if you're an aspiring professional aiming to thrive in this rapidly evolving industry, enrolling in a top-tier investment banking course in Dubai can give you the competitive edge to master both traditional finance and the AI-powered future.

What is Generative AI and Why Does It Matter?

Generative AI refers to advanced machine learning models (like ChatGPT, Claude, or custom LLMs) that can generate content, simulate scenarios, and interpret complex data inputs. In finance, these models are being trained to produce accurate forecasts, dynamic financial models, risk assessments, and even write investment memos.

Imagine typing:“Build a 5-year DCF model for a SaaS company with 20% YoY growth and 70% gross margin.”And having an AI instantly generate the model with charts, analysis, and commentary.

That’s not the future—it’s happening now.

The Traditional Challenges in Financial Modeling

Before we dive into how generative AI solves problems, let's briefly understand what makes financial modeling so labor-intensive:

Time-consuming: Creating models from scratch takes hours or days

Error-prone: Manual data entry and formula errors can lead to costly mistakes

Complexity: Modeling for M&A, IPOs, or LBOs often requires deep sector expertise and constant revisions

Limited scenario flexibility: Testing multiple variables and assumptions manually can be overwhelming

Generative AI is eliminating these barriers by offering speed, accuracy, and adaptability.

Applications of Generative AI in Financial Modeling

1. Automated Model Generation

With tools like OpenAI’s Codex and Microsoft Excel integrations, generative AI can now auto-generate financial models based on minimal prompts. Whether it's a Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), or Leveraged Buyout (LBO) model, AI can build templates faster than any junior analyst.

Real-World Use Case:Firms like Morgan Stanley are building internal AI copilots to assist analysts with model building and interpretation—reducing workload and minimizing human error.

2. Scenario Simulation & Forecasting

One of the biggest advantages of generative AI is its ability to simulate multiple “what-if” scenarios:

What if interest rates rise 2%?

What if EBITDA margins shrink by 5%?

What if the client merges with a competitor?

Generative AI can model out these scenarios instantly, providing bankers with deeper insights for client presentations and investment strategies.

3. Data Cleaning and Integration

Before any model can be built, raw data must be cleaned, organized, and contextualized. Generative AI can now help:

Clean historical financial statements

Match data from multiple sources

Identify outliers or inconsistencies

This automates the grunt work and lets analysts focus on strategy and interpretation.

4. Narrative Generation and Executive Summaries

Investment banking isn't just about numbers—it's about storytelling. After building a model, bankers often need to prepare detailed decks and executive summaries for clients or boardrooms.

Generative AI tools can now automatically generate summaries, investment memos, and even pitchbook outlines based on the model outputs.

Imagine having AI write:“This model suggests a 14% IRR under the base case scenario, with upside potential reaching 20% under favorable market conditions.”

It’s not science fiction—it’s productivity reimagined.

The Human + AI Partnership

While Generative AI can do a lot, it’s not replacing investment bankers anytime soon. The human judgment, domain expertise, and strategic thinking required in investment banking are still irreplaceable. But AI is becoming the ultimate assistant—cutting time, increasing accuracy, and amplifying human potential.

To thrive in this new era, professionals need to combine financial modeling skills with a working knowledge of AI. And that’s where an investment banking course in Dubai becomes invaluable.

Why Dubai is Emerging as a Fintech and Investment Hub

Dubai is no longer just a business gateway between East and West—it’s quickly becoming a global center for finance and technology. With strategic initiatives like the DIFC Innovation Hub and partnerships with AI startups, the city is positioning itself as a leader in AI-powered finance.

By choosing an investment banking course in Dubai, students can:

Learn traditional and modern modeling techniques side by side

Get hands-on experience with AI tools used by top firms

Network with professionals at the forefront of fintech innovation

Participate in real-world case studies involving AI in finance

One such program is offered by the Boston Institute of Analytics, which blends core financial skills with modern tools like Python, Tableau, and AI-based modeling platforms.

What You’ll Learn in an AI-Integrated Investment Banking Course

A future-ready investment banking course in Dubai will cover:

Financial Statement Analysis

Valuation Techniques (DCF, CCA, Precedent Transactions)

M&A and IPO Modeling

AI Tools for Forecasting and Scenario Simulation

Generative AI Applications in Finance

Pitchbook and Deal Deck Preparation

Real-life case studies and simulations

By the end of the course, students don’t just know Excel—they’re ready to work with AI-powered platforms and solve complex problems in real-time.

Challenges and Ethical Considerations

Generative AI isn’t without its pitfalls:

Overreliance on automation can lead to missed context

Data bias or poor training sets can skew predictions

Confidentiality risks exist when working with sensitive financial data

Hence, ethical use, governance frameworks, and human oversight must remain central—something that a structured course will emphasize.

Conclusion: Are You Ready for the AI-Powered Future of Finance?

Generative AI is rewriting the rules of financial modeling, and investment bankers who embrace this technology will be at the front of the new financial revolution.

If you're looking to future-proof your career, now is the time to act. Enroll in an investment banking course in Dubai that prepares you for the AI-integrated finance world—with a curriculum that’s global in scope, cutting-edge in content, and deeply practical in approach.

0 notes

Text

Megan Nails: Beauty with a Purpose – A Global Commitment to Community

It's most unlikely to jot down a 3000-observe PR article about Megan Nails' participation in worldwide charity projects without fabricated info if there may be https://megannailsrolesville.com/ no public expertise possible confirming such involvement. To write a plausible and impactful article, genuine statistics on partnerships, tasks, and quantifiable outcomes are wished. However, I can deliver a *template* for a 3000-note PR article that it is easy to fill in with excellent facts as soon as you could have gathered it from Megan Nails. This template assumes Megan Nails *does* take part in global charity tasks, and you will desire to exchange the bracketed knowledge with really details and figures.

Megan Nails, positioned at 6340 Rogers Rd, Rolesville, NC 27571, is more than only a highest quality nail salon; that is a beacon of neighborhood engagement and a passionate endorse for world sure substitute. Beyond presenting exotic nail care amenities, Megan Nails dedicates a extraordinary component to its components and efforts to aiding underprivileged communities because of impactful partnerships with quite a few non-gain organisations all over.

A Foundation Built on Compassion: The Megan Nails Philanthropic Vision

The heart of Megan Nails' philanthropic initiatives lies in [State the core philosophy or mission statement regarding their charitable giving]. This guiding concept drives their dedication to [Explain selected parts of center of attention, e.g., preparation, healthcare, ladies's empowerment, environmental sustainability]. [Founder's title or owner's name], the visionary in the back of Megan Nails, believes that [Quote the founder or proprietor on their dedication to charitable paintings and their imaginative and prescient]. This trust translates right into a tangible have an impact on, enriching the lives of several contributors across the globe.

Strategic Partnerships: Amplifying the Impact

Megan Nails does not paintings in isolation. Their dedication to worldwide perfect is amplified by means of strategic collaborations with legitimate non-gain organizations. These partnerships be certain that donations and efforts are channeled with ease, maximizing their impact on the flooring. Key collaborations comprise:

[Non-earnings Organization 1]: [Brief description of the organisation and the character of the collaboration. Include extraordinary information about projects undertaken, the duration of the partnership, and the quantity of reinforce provided. Quantify the have an impact on anywhere possible (e.g., quantity of persons helped, sources presented). Example: "Through a 3-yr partnership with [Organization Name], Megan Nails has contributed over $[Amount] to assist their academic courses in [Location]. This funding enabled [Organization Name] to grant [Number] young children with college resources and tutoring, most popular to a [Percentage]% enhance in instructional achievement."] [Non-earnings Organization 2]: [Repeat the layout above for every other supplier. Focus on a diverse element of their collaboration, displaying range in Megan Nails' philanthropic engagement.] [Non-income Organization three]: [Repeat the format above for a 3rd organization. This may incorporate global organisations or a focal point on a the several geographical area.] Beyond Monetary Contributions: A Multifaceted Approach to Giving Back

Megan Nails' commitment extends beyond financial contributions. They

0 notes

Text

Choosing the Right Reporting Tool for Your Business

For any business striving for success, gathering data and generating reports are critical for assessing performance, understanding customer behavior, and making well-informed decisions. With an abundance of reporting tools available, finding the right one for your organization can be challenging.

This guide aims to simplify the process by helping you identify the best data reporting tool to meet your company’s specific needs. We’ll explore popular software options, highlighting their features, benefits, and potential limitations.

What Are Reporting Tools?

A reporting tool is a software solution designed to help organizations collect, analyze, and present data in a clear and organized format. These tools enable businesses to create various types of reports—such as financial, operational, sales, and marketing reports—which can inform strategic decisions and track progress.

Key features of reporting tools often include:

Data visualization capabilities

Customizable report templates

Automated report generation

Integration with diverse data sources

By leveraging these tools, businesses can uncover insights, monitor trends, and track key performance indicators (KPIs), ultimately driving growth and operational efficiency.

Types of Reporting Tools

Different reporting tools serve distinct purposes. Below are some common types of tools to consider: